Payroll & Employee Benefits Management

At Lead Business Consulting, we offer expert Payroll & Employee Benefits Management Services designed to streamline your operations, ensure legal compliance, and boost employee satisfaction. Our comprehensive payroll solutions cover everything from accurate salary calculations, paycheck processing, and direct deposit management, to tax filing, compliance with labor laws, and regulatory reporting. We take the complexity out of employee payroll management so you can focus on business growth. Our team ensures timely payroll tax filing, error-free payroll processing, and automated record keeping using the latest payroll software systems and HR tools.

We also specialize in employee benefits administration, helping companies create competitive benefits packages that include health insurance, retirement plans, paid time off, 401(k) management, worker’s compensation, and fringe benefits. Our services help improve employee retention, enhance workplace productivity, and maintain full compliance with local, state, and federal employment laws. We tailor our payroll and benefits services to meet the unique needs of your business—whether you’re a small startup or a growing enterprise.

We also specialize in employee benefits administration, helping companies create competitive benefits packages that include health insurance, retirement plans, paid time off, 401(k) management, worker’s compensation, and fringe benefits. Our services help improve employee retention, enhance workplace productivity, and maintain full compliance with local, state, and federal employment laws. We tailor our payroll and benefits services to meet the unique needs of your business—whether you’re a small startup or a growing enterprise.

With our outsourced payroll services, you reduce overhead costs, avoid penalties, and eliminate the stress of managing ever-changing payroll regulations. As a trusted payroll service provider, Lead Business Consulting is committed to accuracy, confidentiality, and efficiency. Our advanced cloud-based payroll solutions and automated HR systems make payroll and benefits management simple and reliable.

Why Payroll & Employee Benefits Management Matters

Effective Payroll and Employee Benefits Management is vital for business success because it directly impacts employee satisfaction, regulatory compliance, and operational efficiency. When payroll is handled accurately and on time, it builds trust, improves employee retention, and boosts morale—key factors in creating a productive workplace. On the other hand, mistakes in payroll processing, late payments, or incorrect tax deductions can lead to penalties, legal issues, and unhappy employees. That’s why businesses of all sizes—from startups to enterprises—are investing in professional payroll services and benefits administration. Managing payroll taxes, direct deposits, and employee compensation requires expert knowledge of constantly changing labor laws and tax regulations.

Similarly, offering competitive employee benefits packages like health insurance, retirement plans, and paid time off helps attract top talent and stay competitive in today’s workforce. A streamlined HR and payroll system not only reduces administrative burdens but also ensures full compliance with local, state, and federal regulations. By outsourcing payroll and benefits management to trusted experts like Lead Business Consulting, companies can save time, reduce errors, avoid penalties, and focus on strategic growth.

Our Payroll & Employee Benefits Management Services

1. End-to-End Payroll Processing Services

We provide accurate and timely payroll processing using the latest software and automated systems. Our team handles:

- Employee salary calculation

- Overtime, bonuses, and commissions

- Tax deductions and statutory contributions

- Payroll tax filing and reporting

- Direct deposit management

- Pay stub generation

2. Employee Benefits Administration

Attracting and retaining top talent requires a competitive and well-structured benefits plan. We help businesses design and manage cost-effective employee benefits packages, including:

- Health insurance

- Dental and vision coverage

- Life and disability insurance

- Retirement plans (401(k), pensions)

- Paid time off (PTO) and sick leave

- Employee wellness programs

3. Global Payroll and Benefits Solutions

If you operate internationally, our global payroll and benefits management services ensure consistency and compliance across multiple countries. We support:

- Multi-country payroll processing

- Global tax compliance

- Currency conversion and payment handling

- International employee benefits integration

- Local labor law adherence

4. HR & Payroll Integration

We offer seamless HR and payroll software integration to unify employee data, reduce duplication, and simplify processes. This service includes:

- Cloud-based payroll systems

- HRIS (Human Resource Information System) setup

- Real-time reporting dashboards

- Employee self-service portals

5. Statutory Compliance & Tax Filing

Avoid costly penalties and audit issues with our payroll tax compliance and filing expertise. We help you meet all legal requirements regarding:

- Social security contributions

- Income tax withholdings

- Local employment laws

- Government filing deadlines

6. Employee Onboarding & Offboarding Support

We make transitions smooth for both new hires and exiting employees. Our employee lifecycle services include:

- Payroll setup for new hires

- Final settlement for terminated employees

- Exit documentation

- Benefit continuation (COBRA or similar)

7. Payroll Reporting & Data Insights

Our service provides comprehensive payroll reports to help you understand labor costs, track expenses, and forecast budgeting:

- Custom payroll reports

- Departmental cost tracking

- Overtime analysis

- Headcount and turnover insights

Fields We Serve

We provide payroll and employee benefits solutions to a diverse range of industries:

🏥 Healthcare & Medical Services: Payroll, benefits, and compliance for healthcare providers.

🏬 Retail & E-commerce: Sales analytics, pricing strategies, and customer retention.

🧾 Accounting & Financial Services: Outsourced payroll, bookkeeping, and financial reporting.

🛠️ Construction & Real Estate: Project-based payroll, contractor compensation, and financial analysis.

🍽️ Hospitality & Food Services: Payroll, labor cost analysis, and employee benefits management.

🎓 Education & Training Providers: Scalable payroll and staff management solutions.

🧪 Technology & Startups: Growth forecasting and payroll solutions for tech companies.

🚚 Logistics & Transportation: Fleet payroll and cost tracking for logistics firms.

🎨 Creative & Media Agencies: Time tracking, benefits, and brand positioning.

🧑⚕️ Professional Services: Payroll and strategic planning for law firms, consultants, and HR agencies.

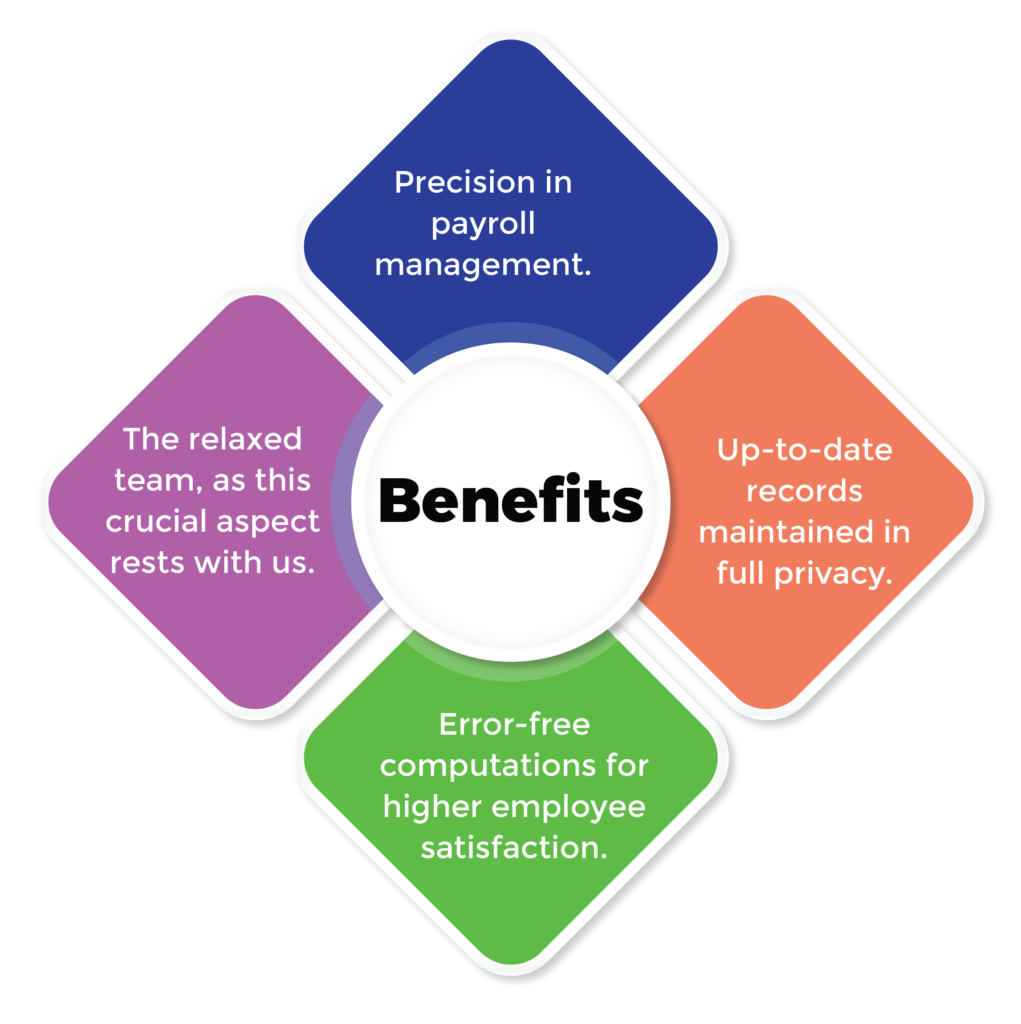

Benefits of Partnering with Lead Business Consulting

✅ All-in-One Business Consulting Services

Lead Business Consulting offers end-to-end support in marketing strategy, financial services, data analysis, payroll and employee benefits management, and business planning. With a full suite of solutions, we serve as a one-stop consulting firm for businesses aiming to grow efficiently.

✅ Tailored Strategies for Every Business Size

We understand that each business has unique challenges. Whether you’re a startup, small business, or a growing enterprise, we deliver customized business solutions aligned with your goals, industry trends, and target market.

✅ Increased Operational Efficiency

By outsourcing tasks such as payroll processing, HR management, bookkeeping, and social media management, your business can eliminate time-consuming back-office work and focus on what really matters—growth and customer service.

✅ Cost Reduction and Budget Optimization

Save money on full-time staff and reduce costly errors with our affordable payroll services, outsourced accounting, and cost management consulting. Our solutions are designed to maximize profit and minimize waste.

✅ Advanced Data Analytics for Smarter Decisions

Use real-time insights from our data analysis tools, including Google Analytics, basket size analysis, and competitor analysis, to drive informed decision-making, improve marketing ROI, and optimize business performance.

✅ Secure Cloud-Based Technology

We implement modern cloud-based platforms for payroll automation, financial reporting, and employee benefits administration, ensuring secure, compliant, and accurate processes accessible anytime, anywhere.

✅ Regulatory Compliance & Risk Reduction

Stay ahead of evolving tax regulations, labor laws, and financial compliance requirements. We help protect your business from fines, penalties, and legal risks with proactive compliance strategies.

✅ Enhanced Employee Satisfaction & Retention

Deliver accurate, on-time payroll and competitive employee benefits packages (health insurance, retirement plans, bonuses, PTO) to improve morale, reduce turnover, and build a loyal workforce.

✅ Scalable Support for Long-Term Growth

Whether you’re expanding to new markets or introducing new services, our scalable consulting solutions grow with your business. We provide strategic planning and performance tracking every step of the way.

✅ Trusted Industry Expertise

With a team of experienced consultants, financial analysts, marketers, and HR professionals, Lead Business Consulting delivers measurable results, professional support, and strategic guidance that drives sustainable success.

FAQs – Payroll & Employee Benefits Management

1. What is included in payroll services?

Our payroll services include salary calculations, tax deductions, benefit deductions, direct deposit processing, payroll tax filings, and customized reporting.

2. Can I outsource payroll for international employees?

Yes! We offer global payroll solutions, ensuring tax compliance and timely salary disbursement across different countries.

3. How does employee benefits management work?

We help you choose and administer the right benefits plans such as health insurance, retirement, and wellness programs. We also handle compliance and employee communication.

4. Are your services compliant with local labor laws?

Absolutely. We monitor legal updates across jurisdictions and ensure full compliance with tax, labor, and benefits laws.

5. What payroll software do you use?

We use top-rated cloud-based payroll systems compatible with HR platforms and customizable to your business size and needs.

6. Can I get custom reports on payroll and labor costs?

Yes. We offer tailored reports for labor cost analysis, departmental expenses, headcount tracking, and more.

Get a Free Consultation Today

Ready to simplify your payroll and employee benefits management while improving accuracy, compliance, and employee satisfaction? Contact Lead Business Consulting for a free consultation and let us customize a solution that fits your business needs.

Contact us now for a free consultation and take the first step towards business!