Profit Projection for Business

What is Profit Projection?

Profit projection is a critical financial forecasting tool that helps businesses estimate future profits based on expected revenue, operating costs, market trends, and business performance. Also known as profit forecasting, this strategic planning method enables companies to set financial goals, allocate resources effectively, and make informed decisions to maximize profitability. By analyzing past financial data, projected sales, variable and fixed expenses, and profit margins, businesses can create an accurate profit projection model to anticipate growth and identify potential financial risks. At Lead Business Consulting, we specialize in profit projection services designed to support small businesses, startups, and large enterprises in developing a clear roadmap for financial success.

Whether you need a monthly profit forecast, quarterly earnings projection, or annual profitability estimate, our expert consultants use advanced financial analysis, revenue modeling, and business intelligence to deliver reliable and data-driven insights. A well-crafted profit projection is essential for securing investors, managing cash flow, setting pricing strategies, and measuring overall business performance. As part of our comprehensive financial planning and analysis services, profit projections work in sync with budgeting, break-even analysis, sales forecasting, and cost management solutions to provide a full picture of your company’s financial health.

With increasing global competition and economic uncertainty, accurate profit projection helps business owners make proactive decisions to optimize income, reduce expenses, and ensure sustainable growth. Keywords such as financial forecasting, profit forecasting for small businesses, projected earnings, business profit estimation, startup financial planning, future revenue prediction, and financial projection services are trending worldwide, making profit projection one of the most searched business consulting topics today. At Lead Business Consulting, our mission is to empower your financial journey through data-driven forecasting and actionable financial strategies that drive growth, stability, and long-term profitability.

Importance of Profit Projection in Business Success

1. Financial Planning & Decision-Making

Profit projection provides valuable insights into your company’s financial health. By estimating future profits, businesses can make strategic decisions about hiring, marketing investments, product development, and expansion plans.

2. Cash Flow Management

Maintaining a steady cash flow is vital for operational stability. Profit forecasting helps businesses predict revenue streams, control expenditures, and avoid financial shortfalls.

3. Investor & Stakeholder Confidence

Investors and stakeholders require accurate financial projections before committing funds. A well-prepared profit forecast increases credibility, improves investor confidence, and enhances business valuation.

4. Identifying Growth Opportunities

Analyzing past trends and predicting future profitability allows businesses to seize market opportunities, introduce new products or services, and optimize pricing strategies.

5. Risk Management & Contingency Planning

Profit projection helps businesses anticipate financial risks and create contingency plans. By preparing for potential downturns, companies can mitigate losses and sustain growth.

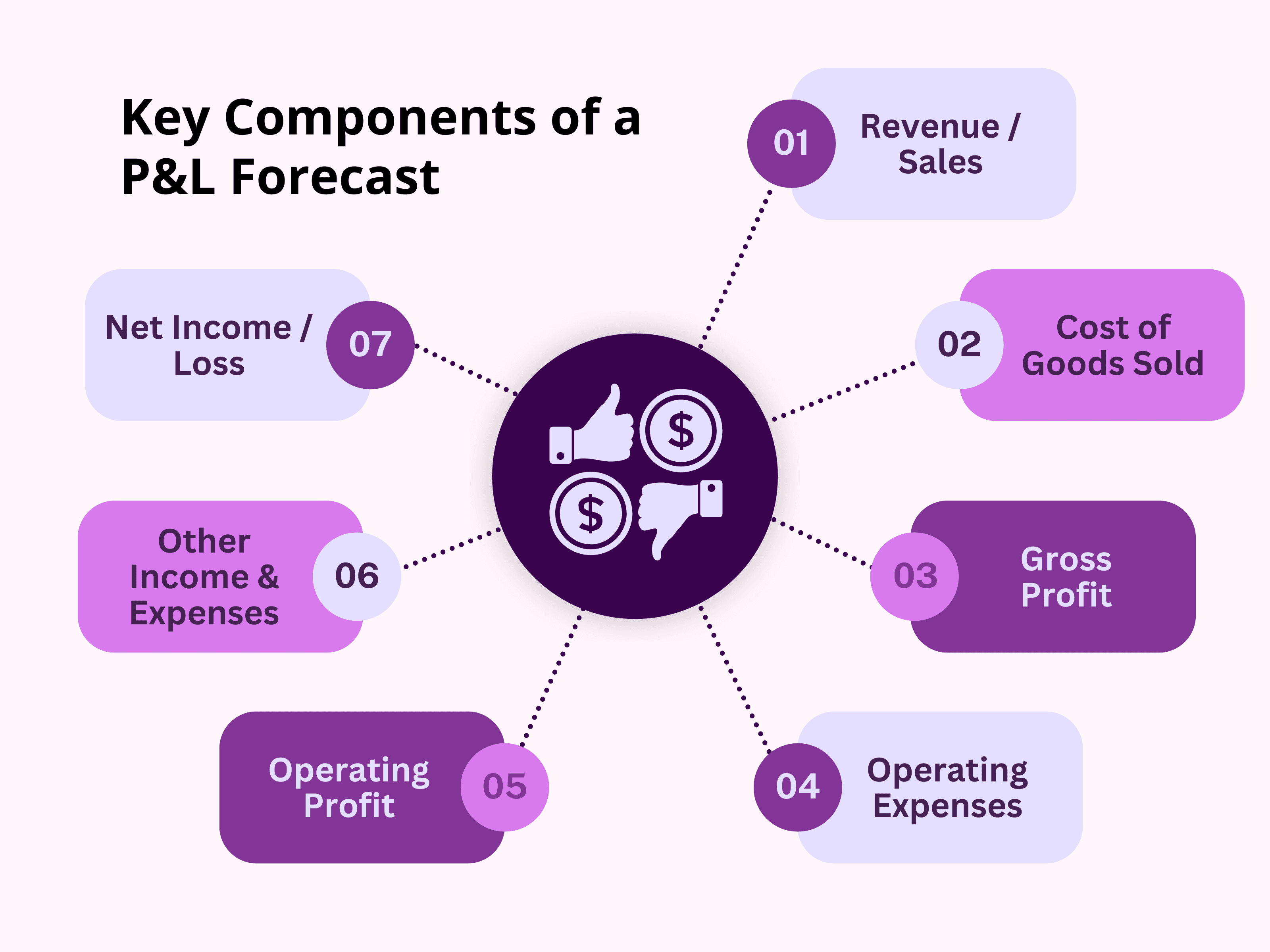

Key Components of Profit Projection

To create a reliable and accurate profit projection, businesses must consider several essential financial components. Below are the key elements that form the foundation of a successful profit forecast:

Projected Revenue

Estimates future income based on expected sales, market demand, pricing strategies, and customer behavior. Crucial for forecasting business growth.

Cost of Goods Sold (COGS)

Includes direct costs involved in producing goods or delivering services. COGS is subtracted from revenue to calculate gross profit.

Operating Expenses

Covers all fixed and variable business expenses such as salaries, rent, utilities, marketing, software subscriptions, and administrative costs.

Gross Profit Margin

Measures profitability after accounting for direct production costs. A strong gross margin is vital for evaluating financial health.

Net Profit Estimation

Calculates remaining profit after all expenses, taxes, and interest. The key for measuring bottom-line business performance.

Sales Forecasting

Predicts future sales volume using historical data, market trends, and seasonal factors. A core element in accurate profit projection.

Cash Flow Projections

Assesses incoming and outgoing cash over time to ensure liquidity and operational sustainability.

Market and Industry Analysis

Includes external factors like competitor activity, market demand, and economic conditions that influence profitability.

Break-even Analysis

Identifies the sales volume needed to cover costs and begin generating profit. Critical for startups and new product launches.

Business Goals and KPIs

Align profit projections with your company’s financial targets and key performance indicators (KPIs).

At Lead Business Consulting, we integrate all these components into a custom profit projection strategy tailored to your business. Our expert consultants use financial forecasting tools, revenue modeling, and data-driven insights to ensure accurate, actionable results that support growth, funding, and long-term profitability.

How to Create a Profit Projection for Your Business

Creating a profit projection is a critical step in effective financial planning, helping businesses make informed decisions, attract investors, and drive sustainable growth. Here’s a step-by-step guide to building a clear and accurate profit projection:

1. Gather Historical Financial Data

Start with accurate records of past income, expenses, and sales trends. Historical data forms the foundation for reliable revenue forecasting and helps identify seasonal patterns.

2. Forecast Sales Revenue

Estimate future sales based on market research, industry benchmarks, customer demand, and promotional strategies. Use tools for sales forecasting, monthly revenue estimation, and growth projections.

3. Calculate the Cost of Goods Sold (COGS)

Determine the direct costs associated with producing your products or delivering services. This includes materials, labor, and manufacturing costs essential for calculating gross profit margin.

4. Estimate Operating Expenses

List all fixed and variable expenses, such as rent, payroll, marketing, insurance, utilities, and software tools. These are crucial for estimating net profit and managing cash flow.

5. Project Gross and Net Profit

Subtract COGS from revenue to find gross profit, then deduct operating expenses, taxes, and interest to determine net profit projection.

6. Conduct Break-even Analysis

Identify the sales volume you need to cover costs and begin making a profit. This step is vital for startups and new business units.

7. Incorporate Market Trends and Business Goals

Adjust your projections based on industry performance, competitor analysis, and your company’s strategic objectives and KPIs.

8. Review and Update Regularly

Profit projections should be dynamic. Review them monthly or quarterly to adjust for market shifts, internal changes, or new opportunities.

At Lead Business Consulting, we specialize in building accurate, customized profit projections using financial modeling, income forecasting, and cash flow analysis. Whether you’re a small business or a growing enterprise, we help you build a strong financial roadmap for success.

Tools & Software for Profit Projection

Using the right tools and software for profit projection is essential for accurate financial planning, smarter decision-making, and sustainable business growth. Today’s businesses rely on a mix of cloud-based accounting platforms, financial forecasting software, and data analytics tools to create reliable profit projections. Some of the most popular and effective tools include QuickBooks, Xero, FreshBooks, Microsoft Excel, Google Sheets, and advanced platforms like LivePlan, PlanGuru, and Fathom. These solutions help automate key tasks such as revenue forecasting, cost tracking, expense management, and cash flow analysis.

With built-in templates and customizable dashboards, you can project income, analyze gross and net profit margins, and assess financial performance in real time. Tools like QuickBooks Online and Xero integrate seamlessly with banking systems, payroll, and inventory, enabling more accurate COGS calculations and net profit estimation. For startups and small businesses, LivePlan and PlanGuru are excellent for creating business plans, visual financial models, and break-even analysis. Microsoft Excel and Google Sheets remain essential for those who prefer hands-on control and customized forecasting formulas. By leveraging these tools, businesses can develop precise profit projections, identify revenue trends, forecast future performance, and prepare for funding or investment opportunities.

At Lead Business Consulting, we use industry-leading financial software and data visualization tools to build tailored profit projections that align with your business goals. Whether you’re a startup looking to attract investors or an established company planning expansion, our expert consultants ensure your projections are backed by the best technology and real-time financial insights. Incorporating the right tools not only improves accuracy but also saves time and enhances strategic planning across departments. Invest in powerful profit projection tools today to strengthen your financial roadmap and drive long-term profitability.

Common Challenges in Profit Projection & How to Overcome Them

1. Unpredictable Market Conditions

Solution: Stay informed about industry trends, monitor competitor pricing, and adjust forecasts accordingly.

2. Inaccurate Revenue Estimation

Solution: Base revenue projections on historical data, customer demand, and marketing performance.

3. Underestimating Expenses

Solution: Include all fixed and variable costs, account for inflation, and plan for unexpected expenses.

4. Lack of Financial Expertise

Solution: Use financial consultants or software tools to create accurate forecasts and improve financial literacy.

FAQs About Profit Projection

1. What is the difference between profit projection and revenue forecasting?

Profit projection estimates net income after expenses, while revenue forecasting focuses only on predicting total sales.

2. How often should I update my profit projections?

Businesses should update their profit projections quarterly or whenever significant market changes occur.

3. Can small businesses benefit from profit projection?

Yes, even small businesses can improve financial stability, optimize cash flow, and attract investors with accurate profit forecasts.

4. What factors can impact profit projections?

Key factors include market demand, pricing strategy, operational costs, economic trends, and competitor actions.

5. How can I improve the accuracy of my profit projections?

Use reliable financial data, industry benchmarks, and forecasting tools to create more accurate profit estimates.

Conclusion

Profit projection is a fundamental financial tool that helps businesses plan for success, manage risks, and maximize profitability. Companies can create accurate financial forecasts and drive sustainable growth by analyzing market trends, setting realistic revenue goals, and tracking expenses. Investing in profit projection enhances decision-making and strengthens business stability in a competitive market.

Contact us now for a free consultation!