Breakeven Analysis: Calculate Breakeven Point Formula

Introduction to Breakeven Analysis

Breakeven analysis is a crucial financial tool that helps businesses determine the point at which total revenues equal total costs, resulting in neither profit nor loss. By understanding breakeven points, companies can make informed decisions about pricing strategies, cost management, and profitability. Whether you are a startup or an established business, breakeven analysis provides a clear picture of financial health and helps businesses set realistic revenue targets. In today’s competitive market, performing regular breakeven analysis allows businesses to optimize operations, reduce financial risks, and ensure sustainable growth. For accurate results, it’s important to calculate breakeven point formula using the key elements involved: fixed costs, variable costs, and sales revenue. These components together form the foundation of this essential financial calculation.

Understanding your breakeven point not only enables better cost management but also aids in identifying optimal pricing models and profit margins. For businesses involved in manufacturing, retail, or service industries, breakeven analysis is an indispensable tool for long-term success. This analysis also plays a vital role in evaluating investment opportunities, helping decision-makers allocate resources efficiently. Additionally, breakeven analysis is often used in conjunction with other financial tools such as profit projection, cost-volume-profit analysis, and sales forecasting to provide a comprehensive view of a company’s financial standing.

Conducting a thorough break-even analysis can significantly enhance business strategy by offering insights into scalability and growth potential. It also assists in identifying areas where cost reduction or sales improvement can positively impact the bottom line. As part of a sound financial management system, breakeven analysis helps businesses navigate economic uncertainties and ensure profitability, making it a must-have for any organization striving for financial stability and success.

What is Breakeven Analysis?

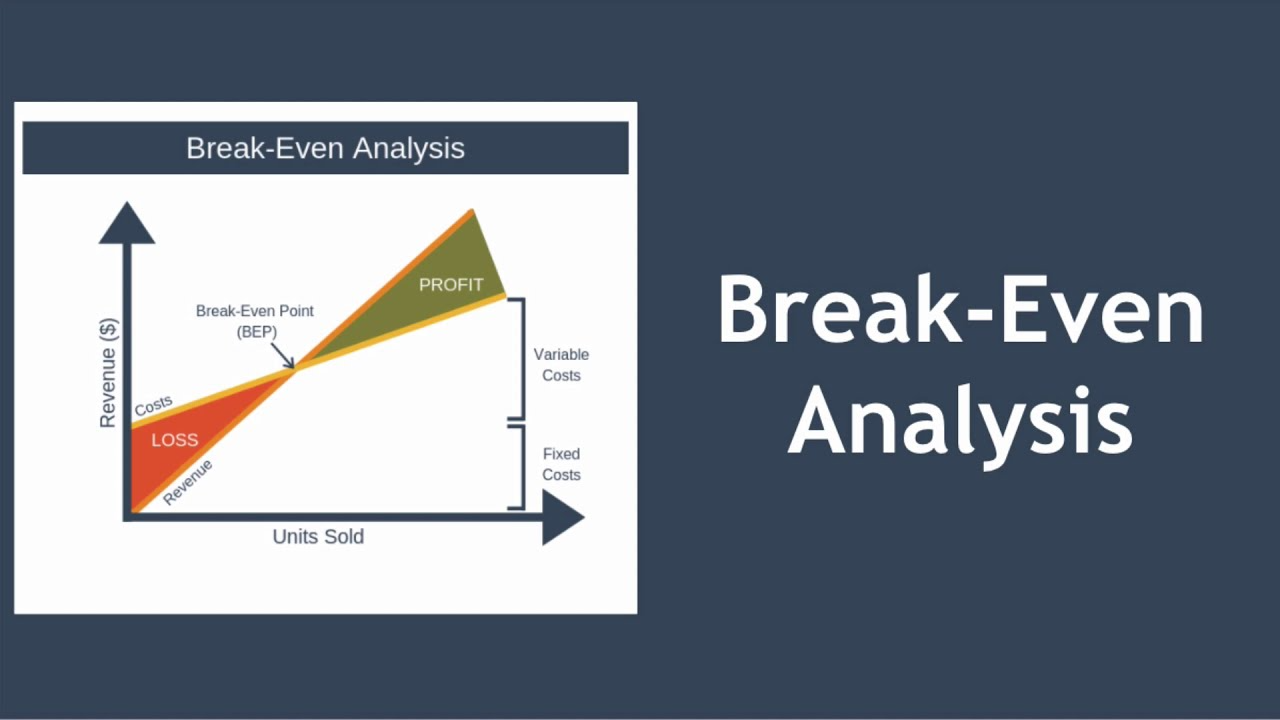

Breakeven analysis is a financial tool that helps businesses determine the point at which their total revenues equal their total costs, meaning they neither make a profit nor incur a loss. This point is called the breakeven point. By understanding the breakeven point, businesses can assess how much they need to sell to cover their fixed and variable costs. This analysis is essential for businesses of all sizes, from startups to established enterprises, as it helps in making key decisions related to pricing strategies, cost management, and profit optimization.

Breakeven analysis involves three main components:

Revenue: The income generated from selling goods or services.

Variable Costs: These costs vary depending on the level of production or sales (e.g., raw materials, direct labor).

Fixed Costs: These are the costs that remain constant, regardless of how much a business produces or sells (e.g., rent, salaries).

The breakeven point is calculated by dividing fixed costs by the difference between the selling price per unit and the variable cost per unit. This provides a clear target for how much a company needs to sell to avoid losses. Breakeven analysis is crucial for businesses to evaluate pricing strategies, manage costs efficiently, and plan for profitability. It also helps business owners and managers assess the financial viability of new products or services and make informed decisions about scaling operations or entering new markets.

Understanding breakeven analysis is an integral part of financial planning and ensures that businesses can remain profitable and sustainable in an increasingly competitive marketplace.

Key Concepts of Breakeven Analysis:

- Revenue: This is the total income generated from selling goods or services.

- Breakeven Point: The level of sales where total revenue equals total costs.

- Fixed Costs: These are costs that remain constant, regardless of the volume of goods or services sold, such as rent, salaries, and insurance.

- Variable Costs: These are costs that change in direct proportion to the level of production or sales, such as raw materials, commissions, and packaging.

Why is Breakeven Analysis Important for Businesses?

Breakeven analysis is crucial for understanding the financial health of a business and making strategic decisions. By knowing your breakeven point, you can set competitive prices that ensure profitability. It highlights the relationship between fixed and variable costs, helping you manage expenses effectively. It provides a clear target for sales, enabling you to plan for growth and profitability. Breakeven analysis helps in projecting future sales and profitability.

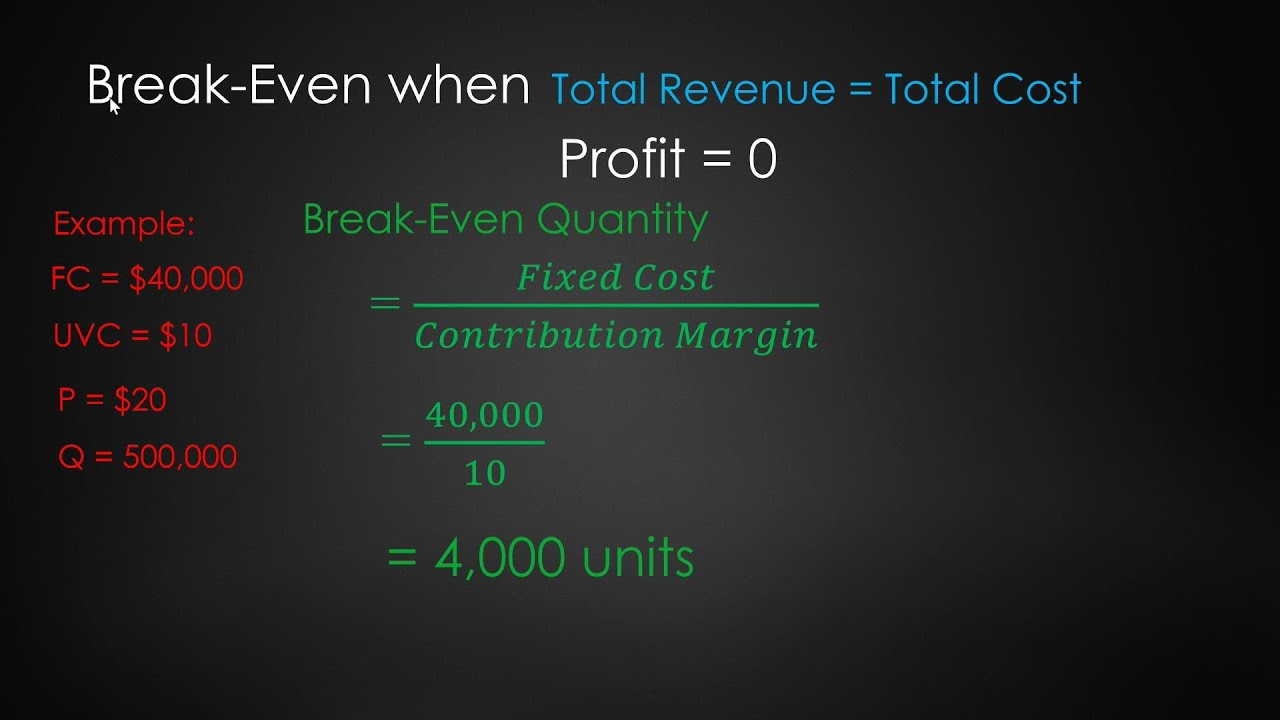

How to Calculate the Breakeven Point?

Calculating the breakeven point is essential for businesses to determine how much they need to sell to cover their costs and avoid losses. The breakeven point represents the number of units or sales required to cover both fixed and variable costs. Here’s how to calculate it:

1. Identify Fixed Costs

Fixed costs are expenses that do not change regardless of how much a business produces or sells. These can include rent, utilities, salaries, insurance, and other overhead costs. Sum up all the fixed costs for your business.

2. Determine Variable Costs per Unit

Variable costs are costs that fluctuate depending on the production or sales volume. These might include raw materials, direct labor, and shipping. Calculate the cost of producing one unit of your product or providing one service.

3. Calculate the Selling Price per Unit

The selling price is how much you charge customers for each unit of your product or service. This is a crucial value because it directly affects the number of units needed to cover your costs.

4. Use the Breakeven Formula

The basic formula for calculating the breakeven point in units is:

Breakeven Point (in units)=Fixed Costs/Selling Price per Unit−Variable Costs per Unit

This formula calculates how many units you need to sell to cover both your fixed and variable costs.

Example:

Let’s say a business has the following details:

Fixed Costs: $10,000

Variable Costs per Unit: $5

Selling Price per Unit: $20

Using the formula:

Breakeven Point=10,000/20−5=10,000/15=667 units

This means the business needs to sell 667 units to break even.

5. Breakeven Point in Sales Revenue

If you prefer to know the breakeven point in terms of sales revenue rather than units, use the following formula:

Breakeven Revenue=Breakeven Point in Units × Selling Price per Unit

This will tell you how much revenue you need to generate to cover your costs.

Why Breakeven Analysis is Important

By calculating your breakeven point, you can make more informed decisions about pricing, sales goals, and cost management. It helps businesses understand the minimum sales needed to avoid losing money and is a crucial element of financial planning and forecasting.

Types of Breakeven Analysis

There are different types of breakeven analysis, each suited to specific business needs:

Unit-based Breakeven: This is the most common form, which calculates the number of units that need to be sold to break even.

Sales Revenue-based Breakeven: Instead of calculating units, this type calculates the revenue required to cover both fixed and variable costs.

Applications of Breakeven Analysis in Business

1. Pricing Strategy

Breakeven analysis helps businesses determine the price at which they need to sell their product or service to cover costs. By analyzing different price points and comparing them to costs, you can identify the most profitable pricing strategy.

2. Cost Management

Understanding your breakeven point allows you to manage your fixed and variable costs effectively. For instance, reducing variable costs can lower the breakeven point, making it easier to achieve profitability.

3. Sales Forecasting

Breakeven analysis is a useful tool for sales forecasting, helping businesses set realistic targets and develop strategies to meet those targets.

4. Profit Maximization

Once you have covered your breakeven point, any additional sales contribute directly to profit. By analyzing your breakeven point regularly, you can identify opportunities for profit maximization.

Factors Affecting Breakeven Analysis

Several factors influence breakeven analysis, including:

Market Demand: A strong market demand can make it easier to reach your breakeven point.

Cost Structure: The ratio of fixed to variable costs will impact how quickly you reach the breakeven point.

Pricing Strategy: Setting competitive prices can either increase or decrease the breakeven point.

Economic Conditions: Economic shifts can affect both costs and demand, influencing your breakeven point.

How Breakeven Analysis Can Help Your Business Grow

Breakeven analysis isn’t just about covering costs – it also plays a significant role in strategic planning and business growth. Investors look at your breakeven analysis to assess the financial viability of your business. A low breakeven point can indicate higher potential for profitability. Knowing your breakeven point helps assess the risks involved in new projects, product launches, or business expansions. A solid understanding of your breakeven point enables better financial planning, making your business more resilient in tough times.

Key Takeaways

Breakeven analysis is a valuable tool for understanding the minimum sales needed to cover costs. It helps with pricing, cost management, and profitability forecasting. Regularly monitoring your breakeven point ensures that your business stays on track toward sustainable growth.

FAQs About Breakeven Analysis

1. What is the breakeven point?

The breakeven point is the level of sales at which a business’s total revenues equal its total costs, meaning no profit or loss.

2. How do you calculate breakeven?

To calculate the breakeven point, use the formula:

Breakeven Point = Fixed Costs / Selling Price per Unit − Variable Cost per Unit

3. What is the difference between fixed and variable costs?

Fixed costs are constant and don’t change with the level of production or sales (e.g., rent), while variable costs fluctuate with the level of production or sales (e.g., materials).

4. How can breakeven analysis help a business?

Breakeven analysis helps businesses determine the sales volume needed to cover costs, set pricing strategies, manage costs, and plan for profitability.

5. Can breakeven analysis be used for pricing strategies?

Yes, breakeven analysis helps businesses set prices that cover their costs and generate profit. By analyzing different pricing strategies, businesses can choose the one that maximizes profitability.

6. What happens if sales exceed the breakeven point?

Any sales beyond the breakeven point contribute directly to profit, making those sales more valuable as the business grows.

7. Is breakeven analysis useful for startups?

Yes, startups need to understand their breakeven point to plan for financial stability and long-term profitability.

Contact us now for a free consultation and take the first step towards business growth and profitability!