Expert Financial Reporting Services

Empower Your Business with Accurate and Strategic Financial Reporting

Services and strategic financial analysis that fuels growth, compliance, and profitability. Our expert team specializes in delivering customized financial reports, real-time financial dashboards, and monthly profit and loss statements that give you a crystal-clear view of your business’s performance. With our data-driven approach, we ensure your financial reports align with global accounting standards and support smarter business decision-making. Whether you’re a startup, small business, or an established enterprise, strategic financial reporting is essential for driving investor confidence, ensuring regulatory compliance, identifying risks, and planning for sustainable growth.

Our services include balance sheet preparation, income statement analysis, cash flow forecasting, and budget vs. actual performance tracking, all tailored to your unique operational needs. We utilize advanced financial reporting tools and automated reporting systems to provide insights that are accurate, timely, and actionable. With a focus on financial transparency and business intelligence, we help you uncover opportunities to reduce costs, increase profitability, and strengthen financial health.

By partnering with Lead Business Consulting, you gain access to industry-best practices in financial management, performance reporting, and fiscal accountability. From GAAP-compliant reports to KPI-driven performance analysis, we deliver the financial clarity and strategic foresight your business needs to scale confidently. Optimize your financial decision-making with powerful, precise, and proactive reporting solutions.

Keywords: accurate financial reporting, strategic financial reporting, business financial reports, profit and loss statements, balance sheet, cash flow forecast, financial reporting services, real-time financial dashboard, GAAP compliance, financial performance analysis, financial reporting for small business, automated financial reports, business intelligence, financial management consulting, fiscal accountability, financial transparency.

What is Financial Reporting?

financial reporting is the process of collecting, analyzing, summarizing, and presenting a company’s financial data in the form of structured documents to provide an accurate view of its financial performance and position. These reports include key documents like the balance sheet, income statement (profit and loss statement), cash flow statement, and statement of shareholders’ equity. The primary goal of financial reporting is to provide transparent, consistent, and standardized financial information to internal stakeholders (like business owners, managers, and employees) and external parties (such as investors, lenders, tax authorities, and regulators).

By following established accounting principles such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), financial reporting ensures that the company’s financial data is reliable and comparable over time and across industries. These reports help stakeholders understand how money is being earned, spent, and managed—enabling smarter decisions around budgeting, investing, and strategic planning.

In essence, financial reporting is more than just compliance—it’s a strategic tool that promotes financial transparency, enhances investor confidence, and drives long-term business success.

Frequently searched keywords: what is financial reporting, financial reporting meaning, the purpose of financial reporting, types of financial reports, GAAP financial reporting, IFRS financial reporting, the importance of financial reporting, financial reporting for small business, accounting, and financial reporting, and business financial documents.

Our comprehensive financial reporting services include:

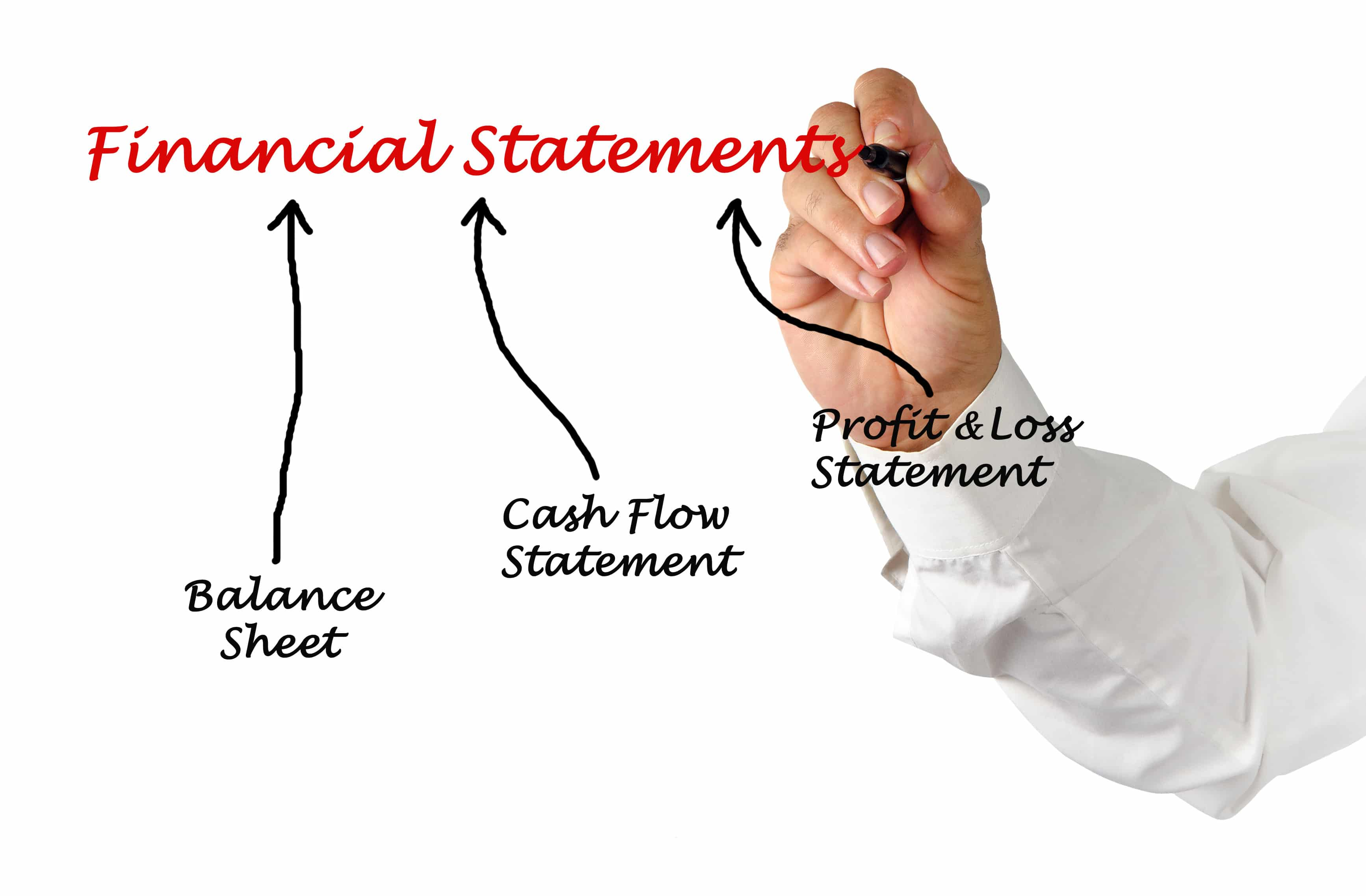

1. Income Statement (Profit & Loss Statement) Preparation

We prepare detailed income statements that show your revenues, expenses, and net profits over a specific period. This helps you track business profitability, assess operational efficiency, and make informed decisions for cost management and revenue growth.

2. Balance Sheet Creation

Our team creates accurate balance sheets that summarize your company’s assets, liabilities, and equity. These reports provide a snapshot of your financial position, helping stakeholders assess liquidity, solvency, and long-term stability.

3. Cash Flow Statement Reporting

We develop structured cash flow statements to monitor how cash is generated and spent in your business. These insights help manage liquidity, plan investments, and ensure you can meet short-term obligations.

4. Custom Financial Dashboards

Access real-time financial dashboards customized to your business KPIs. These visual tools make it easier to track financial metrics, trends, and performance insights, all in one place.

5. Budget vs. Actual Analysis

We compare actual financial performance against planned budgets to identify variances, control costs, and optimize your financial strategy. This ensures your business stays on track with its financial goals.

6. GAAP & IFRS-Compliant Reporting

Our reports follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to meet regulatory requirements and support global business operations.

7. Financial Statement Consolidation

For businesses with multiple entities or subsidiaries, we offer financial statement consolidation to present a unified view of the company’s overall financial health.

8. KPI-Driven Financial Analysis

We deliver key performance indicator (KPI)-based financial analysis to highlight what matters most to your growth. From gross margin to return on investment (ROI), we focus on the metrics that impact your bottom line.

9. Automated Reporting Systems

Streamline your financial reporting with automated tools that reduce manual errors, increase accuracy, and save time. We implement technology that supports consistent and scalable reporting processes.

10. Audit-Ready Financial Reports

Our detailed, accurate, and well-documented reports ensure you are always audit-ready, simplifying your preparation for internal reviews or external audits.

Our Financial Reporting Services Include

1. Income Statement (Profit & Loss Statement)

We prepare comprehensive income statements to track your company’s revenues, expenses, and profits over a specific period. These reports help you understand business performance, identify trends, and assess profitability.

2. Balance Sheet Preparation

Our balance sheets provide a clear snapshot of your business’s assets, liabilities, and equity at any given point. This financial statement helps evaluate your company’s financial stability and overall health.

3. Cash Flow Statement

Our cash flow statements detail the movement of cash in and out of your business. This report is crucial for assessing liquidity, managing working capital, and ensuring your business can meet its financial obligations.

4. Custom Financial Dashboards

We create real-time financial dashboards that allow you to monitor essential key performance indicators (KPIs) and financial metrics in a visual format. These dashboards help track business performance, identify potential issues, and make data-driven decisions.

5. Budget vs. Actual Analysis

Our budget vs. actual analysis compares projected financials against real-time performance. By identifying variances, we help you better understand financial discrepancies and fine-tune your future budgets and forecasts.

6. GAAP & IFRS-Compliant Reports

We prepare financial reports in line with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) to ensure compliance with global standards and improve the credibility of your financial data.

7. Consolidated Financial Statements

For businesses with multiple branches or subsidiaries, we offer consolidated financial statements, providing a unified overview of the company’s financial performance and position across all entities.

8. KPI-Based Financial Reporting

We specialize in delivering KPI-driven financial reporting, focusing on the most relevant performance metrics to give you deep insights into profitability, efficiency, and overall business health.

9. Automated Financial Reporting Systems

Our automated reporting solutions help streamline the financial reporting process, reduce human error, and deliver accurate and timely reports with minimal manual intervention.

10. Audit-Ready Reports

Our financial reports are prepared to be audit-ready, ensuring they meet the highest standards of accuracy and transparency and are fully prepared for external audits and internal reviews.

Why Choose Lead Business Consulting?

At Lead Business Consulting, we provide businesses with tailored, data-driven solutions designed to foster growth and financial success. Our team of seasoned experts specializes in financial reporting services, including balance sheet preparation, cash flow analysis, and income statements, all crafted to meet GAAP and IFRS standards. With a focus on KPI-driven insights, we empower you to make informed, strategic decisions that optimize your business operations. We leverage the latest financial tools and automated systems to deliver timely, accurate reports that ensure your business stays ahead of the competition. Our customized solutions are built around your unique business needs, making us the ideal partner for businesses looking for financial transparency, audit-ready reports, and sustainable growth. Choose Lead Business Consulting for a trusted, results-driven partner dedicated to your financial well-being and long-term success.

Who Needs Financial Reporting Services?

- Small Businesses looking for growth and investor readiness

- Startups that require financial clarity for funding

- Mid-size companies aiming for process improvement

- Enterprises needing scalable, compliant reporting

- Nonprofits for grants, donations, and accountability

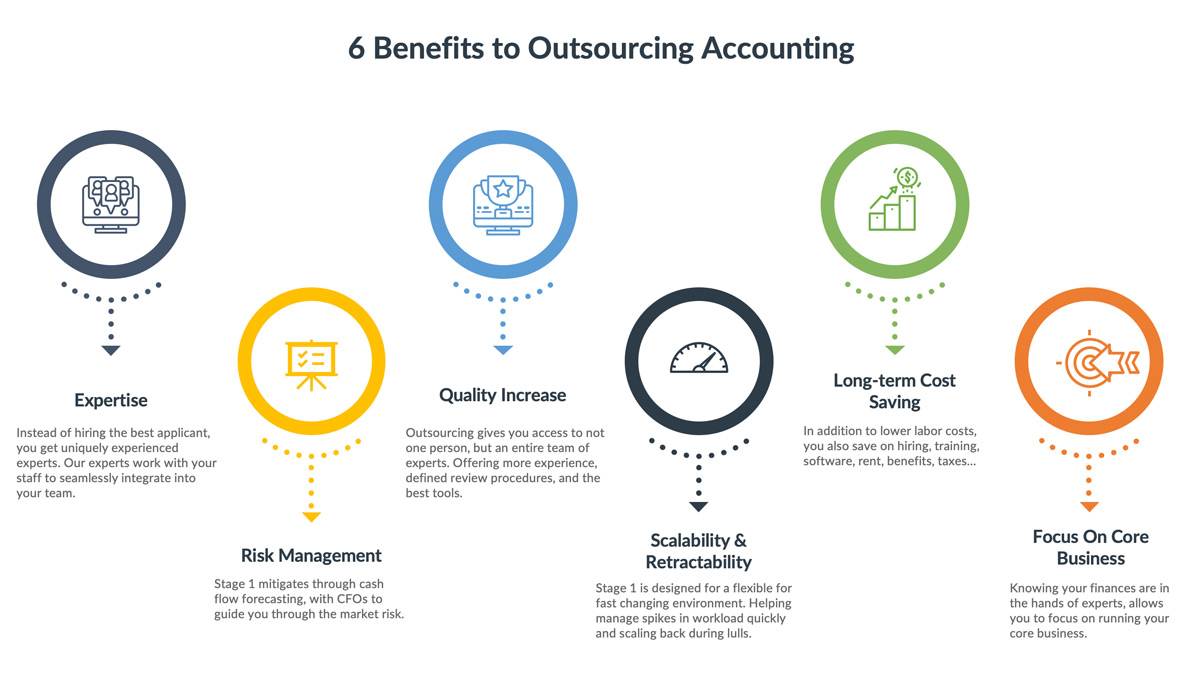

Benefits of Outsourcing Financial Reporting

- Saves Time

- Cost-Effective

- Expert Accuracy

- Ensures Compliance

- Scalable with Growth

Boost Business Intelligence with Financial Reporting

With Lead Business Consulting, financial reporting becomes your competitive edge. Get clear insights into your business performance, make informed decisions, and confidently communicate your results to investors and stakeholders.

Let our financial reporting experts handle the numbers while you focus on growing your business.

Frequently Asked Questions (FAQs)

1. What is financial reporting in accounting?

Financial reporting involves preparing standardized reports like income statements, balance sheets, and cash flow statements that reflect a business’s financial performance over a specific period.

2. Why is financial reporting important?

It provides transparency, helps manage performance, supports strategic decisions, ensures compliance, and attracts investors or lenders.

3. What types of financial reports do businesses need?

Businesses typically need:

- Income Statement (Profit & Loss)

- Balance Sheet

- Cash Flow Statement

- Statement of Equity

- Custom Management Reports

4. Do small businesses need financial reporting?

Yes! Financial reports help small businesses monitor growth, manage cash flow, and prepare for taxes and funding opportunities.

5. Is financial reporting the same as bookkeeping?

No. Bookkeeping involves recording transactions, while financial reporting summarizes and analyzes that data into meaningful reports.

6. What is the difference between GAAP and IFRS?

GAAP is mainly used in the U.S., while IFRS is used internationally. Both are accounting standards but differ in methodologies and reporting principles.

7. How often should financial reports be prepared?

Monthly reports are common for operations. Quarterly and annual reports are required for compliance, strategy, and external stakeholders.

8. Can you help with audit preparation?

Absolutely! We prepare audit-ready financial statements and assist in every stage of the audit process.

Ready to Elevate Your Financial Clarity?

📞 Contact Lead Business Consulting today to schedule your free consultation and discover how our financial reporting services can transform your decision-making, compliance, and profitability.